Has it gone above and beyond the usual staple of fixed deposit, real estate and gold?

Look at some of the richest people in the world, like Bill Gates, Mukesh Ambani or Laxmi Mittal—they aren’t rich because they own a piece of real estate or quantum of gold, but by their investments in ownership of quality and productive businesses.

The ownership in a business can be gained through equities–so if one buys a stock in Nestle, the makers of Milkmaid, Maggi, Nescafe and KitKat, they actually own a part of the conglomerate. Investors, who have equity ownership in select, quality businesses, can benefit a lot by means of capital appreciation and dividend.

The four founders of the company Binoy Joy, Rakhinth Subramanian, Biju John and Suraj Nair met because they used to bump into each other during annual general meetings of companies at various cities in the country. “All of us were working in the capital market industry, were of the same age group and were investors who created wealth through equities, so one fine day over a cup of coffee we decided to start this company that spreads the right culture and spirit for equity investment,” says Suraj Nair, the executive director, research and fund management of MOAT.

Started in October 2013, the unusual name of the company MOAT was inspired from investment guru Warren Buffet’s famous investment theory of ‘economic moat’–which refers to a business’ ability to maintain competitive advantages over its competitors to protect its long term profits and market share.

Kochi based portfolio management company MOAT Financial Services Pvt Ltd. can be best described by their tagline: money simplified. The SEBI authorised investment institution that focuses on the long term interest of investors, ensures high level of accountability, confidentiality and standards of transparency. It targets a new set of investors who are not invested in stocks, especially in Kerala—the target customers being NRIs, corporates and high value individuals.

The Fantastic Four

This successful firm is run by the fantastic four member team, who has different characters, different levels of thinking but what binds them together is the common love for the equity investment market. They claim this to be the strength of MOAT as an organisation. “We are a team of individuals with over a decade of accumulated wisdom in the Indian equity and wealth management industry. We are primarily investors and not traders who have acquired substantial portion of their wealth by investing a majority of own savings in equities alone,” says Rakhinth Subramanian, executive director, business development of MOAT.

A certified Chartered Accountant Binoy Joy, the executive director, operations & fund management, travelled across the globe to chase his passion of being a financial advisor. With an experience of two decades in the field and a widespread knowledge of the financial advisory scene all around the world, Joy knows what is best for an investor.

Suraj Nair, is a software engineer by qualification who has been handling international projects, and had his chance to deeply analyse the working mode of fund management corporations. An adept spokesperson and leader, Nair has the goodwill of being the vice president for reputed portfolio managers in his kitty.

With an in-depth knowledge about business in India and abroad, Rakhinth Subramanian, is a lawyer and has been into the financial industry since the last two decades. As a promoter of a healthcare retail chain in the gulf, Subramanian has a better understanding of international business—so he spearheads the company’s vision of holding the hands of the associates and clients and guiding them.

Last but not the least, the executive director, investor relationships, Biju John, has two decades of experience in capital market and retail sector, and is an expert in understanding the investor’s side of the story. His various specialisation include innovations and promotions, maintaining investor relationships, taking a deep peek into the marketing aspects, and managing accounts.

Since all the directors of the organisation have more than 15 years of high profile investment experience, it helped them in obtaining the SEBI license in a little more than a year.

“Around the world the greatest investors are investors in equity, having invested at the right time. All the great wealth is created by enterprises, by businesses. Nowhere in the world is a billionaire just wealthy due to investments in other options. Owning good equities is like owning a good and productive business or real estate. The trick is to buy great businesses, great franchises and stick to it through good times or bad.”.

The Kerala Investment Market

A growing economy offers plenty of opportunities for investors, and slowly the new age Malayalees are growing—not all are limiting themselves to invest only in physical assets such as gold and real estate. “Kerala till now doesn’t have an entrepreneurial culture—it is more of a consumer society and the only businesses we have are in the education, healthcare and hospitality sector. That’s why equity is an unpopular asset class in this state and most money gets channelized in physical assets. MOAT is in fact getting more clients outside of Kerala, like Hyderabad, Bangalore, Chennai, Mumbai and from a good number of NRIs from USA, Europe and Middle East,” says Nair.

But Kerala plays a huge advantage too, because it is away from all the drama of the stock exchange. It helps one to see through the theatre in the Sensex clearly. “We are real time with the smallest move in the stock markets worldwide, but we are away from the hype. That gives us unusual clarity and deep conviction to make the biggest investments,” shares John.

But is the game changing for the modern investors?

According to Nair, out of India’s 120 crore population of people, less than 2% invest in equities. “Equity is the most underrated asset class in our country, and for a developing economy like India that is something that one should be worried about. The situation in Kerala is much worse because they still prefer investing in gold and real estate over equities.

In the last 10 to 15 years there has been a mad rush to invest and most of the asset class has boomed. The real estate in USA and Gulf has boomed just like in India but not beyond a certain point–in India though it has continued to rise since this is the only country where there is a parallel economy and has too much black money. Most of the people in India considers equity investment as gambling and believes in investing in physical assets more.

This in turn is a problem for the Indian government because in order to have an economic boom, the government needs to channelize physical assets into financial assets. It is only then that an economy can boom, thereby creating more jobs,” he says.

Why do Malayalees see share investment as gambling, and pat comes the reply. “See, equity is not risky asset class as long as you proceed to invest with the right culture. Risk only comes from what we do not understand,” he says simply.

It is true that equity investment is not easy, but it is not a tough task either. As Warren Buffet says, investing is simple, but not easy. The equity market is no gambling place nor is it a spectator sport—so one needs to have a thorough knowledge of this space before entering.

Which stock to invest in? How much to invest? Only an expert could provide answers for these queries. “It is important for every investor to learn the true discipline of investing, show patience in staying invested, build knowledge about the true culture of equities and keep the right company. This calls for a credible, knowledge-based platform that inculcates in the investor the healthy habit of equity investing,” advises John.

What’s MOAT’s role?

“Most of the NRIs realize the fact that whatever money they have made in their respective counties is legal money and when they invest in real estate in India then a good quantum of illegal money is used, which later becomes a problem with the tax authority. This has prompted them these days to opt for equity investments.

However, most of the financial intermediary fail to create a culture and right spirit to invest into equities. This is where MOAT comes into the picture—we are trying to focus in creating the right culture for equity investments. We are telling the world that by buying equity you’re taking a part ownership in that business,” says Nair.

Equity, for the organization, is sacrosanct. It is ownership of a company, and ownership is not traded daily. The equity markets are not a tradable asset class. “If we buy equity in a company, we see ourselves as part owners. Similarly when we invest on your behalf, you are investing like a promoter,” says John.

The clients of MOAT are typically individuals who don’t have the time to research and track their financial investments themselves, but want to invest their money where it gets more personal attention than a mutual fund. This discretionary portfolio management is the essential core of MOAT’s daily work.

But where does the trust factor come from? “We create a portfolio for our investor once they hands over their money to us. They tell us that they do not know anything about the equity share market, so when they pass on their investment decisions to us, they also in turn outsource their conviction, discipline, patience, time and courage,” emphasizes Nair.

He further illustrates this point with a fantastic example. “PAGE Industries was the sole license holder for Jockey in India way back in 2009 when all five of us had faith in the product that it will eventually do well and sell like hotcakes in the country. It was rational to partner with a product like that and so we invested in it. We were right because from a turnover of 200 crores and a stock price of Rs 350 in 2009, Jockey ended up having a turnover of Rs 1,200 crore and a stock price of Rs 12,000 in the last financial year.

Jockey was able to deliver this much earning when inflation was in double digits, bank interest rates were at its peak–they could still do a fantastic business in the last 6 years and expanded its business, and how! So you see, you need have faith in the company and let them start earning. Nobody right now in India is practicing that, so we are just trying to spread the culture of equity investment by telling investors that eventually they take ownership in the business by buying stocks.”

Patience is the key

The fundamental belief of the firm is that patient ownership yields richest dividends and around the world the greatest investors are investors in equity, having invested at the right time. All great wealth is created by enterprise, by business. Hence understanding businesses based on authentic data and predicting future trends is the core skill. “We invest our own faith in mathematics, not emotions. Math does not cheat one; the books of P&L, profits, taxation, etc indicate true value. Separating emotion from all trends is key to our understanding,” says Subramanian.

The entire team believes that a patient investor can create enormous wealth. Take a company like TCS for instance–with a 40,000 crore market cap in 2004 it has become a five lakh crore company in 2014, in just in a span of ten years. An investment in this firm would have rewarded an investor over 12 times. Equities like Nestle, Jockey, Pidilite (makers of Fevicol), Asian Paints, Hawkins Cookers, Bosch, to name a few, have survived the stock market scams, the ongoing wars, epidemics, et al. People tend to get emotional and make incorrect decisions, but the market rewards the strong DNA of these companies.

The principle philosophy

Good investing is about good businesses, good people and good value—and a boutique investment makes investing simpler, more understandable and profitable for the investors through a transparent and efficiently regulated platform. MOAT tries to offer professional and prudent investment management delivered through a boutique concept of personalised service. “We focus on the long-term interest of investors, ensuring a high level of accountability, confidentiality and transparency. We do not forsake our ethics in the quest for wealth and we always try to be in the circle of good people and work with them,” remarks Joy.

The investment philosophy is based on a consistent, long-term, disciplined approach to equities. “We choose investments based on investors’ objectives, focusing on value-oriented methodologies. Every equity investment that we make is viewed as if we were buying a piece of business. We undertake an in-depth analysis by means of quality research before every investment decision is made–and we wait for the price that we find appropriate, before we click ‘buy’,” Joy further explains.

The challenges

“Keralites have a lot of money but you won’t see a lot of Malayalees doing real estate transactions by writing a cheque. In the capital market, we cannot take cash and that’s the biggest challenge we are facing right now in the state. We do believe though, that things will change in India, including Kerala–the whole mentality of the country is gradually changing and we hope to see a shift in the attitude of investors in the next 5 to 6 years when equity will be considered as an asset class,” says Nair.

He further says that they would have loved to invest in global desi companies like Fab India, Being Human, Amul, Cadbury, Bisleri, Frooti, Hidesign, Micromax Mobiles and Flipkart. “But they are not listed, unfortunately. Needless to say, the right to admission is reserved,” says Nair.

So, what’s next?

What MOAT shall strive for, is to find the next hidden gems for the investors to benefit from–the future Coco Colas’ and Nestles’ of the world. In India, most funding houses make money from the vast capital people invest with them, and not from the performance of their picks. Hence, a true investing house is difficult to find, and the true test of a funding house should be performance on their stock picks.

“As we stay away from the incessant din of financial media, our picks are original and often those, the value of which has been undiscovered. They aren’t part of a roller coaster rise-and-fall stock story. They aren’t necessarily the most talked about stocks but they are the most likely to be highly rewarding,” reveals Joy.

For the MOAT team investing is a profession, not business, they insist. The future vision is to bring more young people into this fold to help spread the culture on investing in a proper way. The aim is not to bring in hundreds and thousands of clients, but a few quality individuals who share this culture of investment, and to make history together by investing correctly for them.

The brighter side

There is a renewed interest to invest in India, and the Indian stock market has proven to be far more stable and risk-free than many other markets, if the right stock is chosen. The current times are a throw-back to the old days that applauded transparency, excellence, and a respect for quality.

Some of the factors working for India currently are: a young population, a stable government, an efficient and a visionary global leader, a vibrant democracy, a large talent pool, humongous business opportunities, a strong will in cracking down corruption and black money and government austerity measures.

Keeping these in mind, popular asset classes of yesteryears may not be the stars of tomorrow–over-owned and non-transparent asset classes could become stagnant. The least-preferred and under-owned asset classes of today could become the wealth creators of tomorrow. The asset class of the next decade would be productive, quality businesses. If you’re smart enough to understand the evolving trends, you should go ahead and buy them (just like they did with Jockey in 2009).

We can end this in a hopeful note by taking a closer look at the social media today, or people heading government, that reveals the swing towards responsible corporate performance–the dawn of a new era. Even in the four tumultuous preceding years, there were at least a hundred companies who scaled up their market cap by 20-30 times. For those who saw that, made extremely wise investments. “Join the journey to be citizens of a world of sound decisions. MOAT is an investment lifestyle,” signs off Joy.

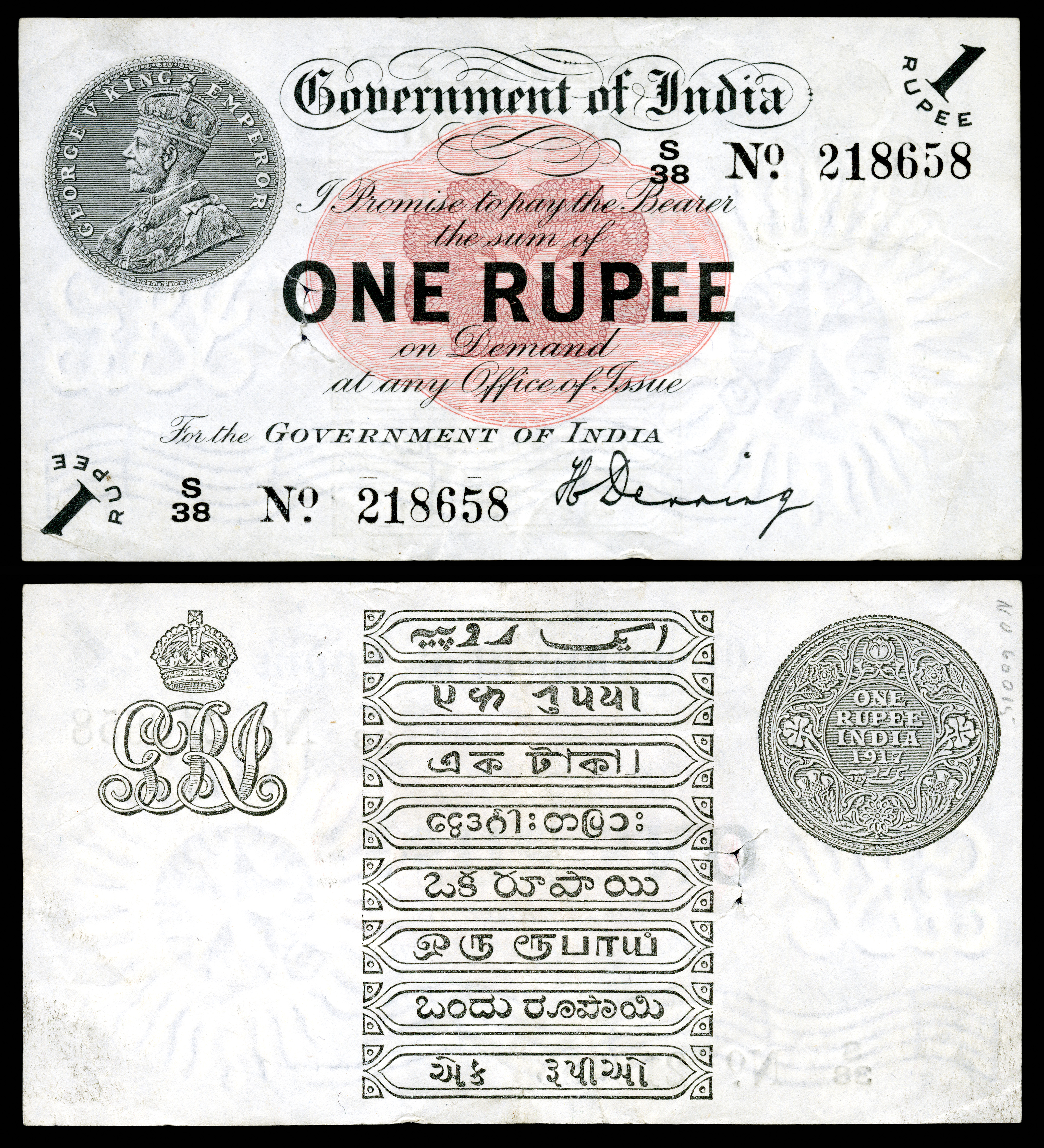

Lead photograph by Godot13 / Smithsonian Institution [Public domain, Public domain or Public domain], via Wikimedia Commons