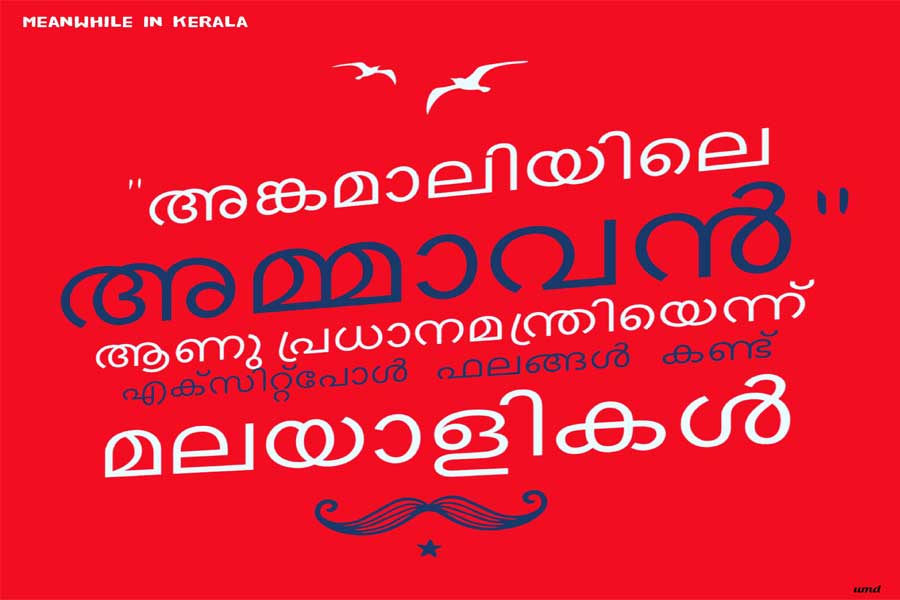

This Vishu, don’t be surprised if your grandparents ask you to share your Paytm or Rupay account details for kaineetam as ATMs run dry. But, it isn’t just the festivities (Vishu and Easter) that are being affected by the cash crunch, daily labourers, pensioners and other low income groups who depend on cash transactions are facing a hard time to get by because of the cash crunch.

This crisis comes months after Prime Minister Narendra Modi demonetised INR 500 and INR 1000 notes triggering a severe paucity of cash across the country. This caused several people to stand hours in queues in front of ATMs for money. The Kerala Finance Minister, TM Thomas Issac confirmed that the crisis indeed has hit the state’s treasury, causing a shortage to disburse salaries and pensions. The main cause for this shortage being RBI not providing enough notes.

This problem even caused an agitation at the SBI Kainatty branch in Wayanad when customers couldn’t withdraw money from the ATM. According to sources, banks have been discreetly told not to replenish ATMs.

“Thankfully, our ATM here has enough cash supply. The only reason I can see for the shortage could be because RBI wants more digital transactions to take place. It is for the same reason that the Prime Minister too has introduced RuPay card. This is an attempt by the government to curb money laundering, circulation of black money and create more transparency in transactions,” says Priya Venugopal, a senior official at SBI.

Last month, RBI Deputy Governor Viral Acharya had indicated that it would take couple of months more before currency balance is restored.

D Dhanuraj, Chairman, Centre for Public Policy Research, says, “According to the March end data, close to INR 17 lakh crore was demonetised, but only INR 12 lakh crore is back in circulation. Which means there is a deficit of INR 5 lakh crores. Also, the government is trying to make all transactions digital. But recently, online transactions have actually reduced, except for Aadhar enabled ones and the UPI gateway payments. An intentional cash crunch according to me is wrong because when the government isn’t giving people access to their hard earned money, it violates an individual’s rights. Instead of forcing people into digital transactions, I feel that the government should educate them and facilitate them to go digital. One cannot except people to take to digitisation easily without equipping them. The lower in come groups are the worst hit in this scenario.”

According to the Finance Minister, the crisis has hit just when the state Government was ready to disburse three months’ welfare pension arrears in view of Vishu and Easter festivals. The government plans to transfer the funds for distribution of welfare pension to the cooperative banks. However, it may mean little if the beneficiaries do not have access to hard cash.

The situation is similar in other parts of the country like Uttar Pradesh and Maharashtra, but nowhere is it as worse off as in Kerala and Telengana.

“Post demonetisation, sufficient notes haven’t been printed and this is causing a shortage of currency notes. RBI officials have informed us that the issue will be resolved only after June. There’s approximately 35% shortage of currency. Plus, recent announcement by the government putting a restriction on transactions above INR 2 lakhs and the fact that people are withdrawing and hoarding cash for a rainy day has reduced currency circulation. Demand for cash is high right now as salaries haven’t been dispensed and it is close to Vishu and Easter. Yet another reason for the shortage is merger of SBT with SBI. Earlier, people could withdraw from SBT ATMs, but with the merger it doesn’t seem possible. With many Keralites having more account with SBT, this seems to be an addition to the existing woes,” says CJ Nandakumar, President, Bank Employees Federation of India.

While the government’s attempt to demonetise could be with the good intention of reducing money laundering, a pre planned move could have averted a disaster. With the lower income groups being the worst hit in this scenario, steps should have been taken to better equip and educate the citizens.

RBI officials declined to comment.

By Arunvrparavur, Taken by me, GFDL via Wikimedia Commons